Horizontal Levels

Last Update: February 1st, 2025

Horizontal levels are one of the simplest yet most powerful concepts in Forex trading, playing a vital role in technical analysis.

These levels are foundational to many trading strategies, helping traders analyze price movements effectively. Interestingly, horizontal levels aren’t just a supportive tool—they can serve as a standalone trading strategy.

By observing key price points where noticeable changes occur and marking these levels, traders can uncover potential trade opportunities with improved accuracy.

In fact, recognizing horizontal support and resistance lines on complex charts often reveals market trends that might otherwise go unnoticed.

What Are Horizontal Levels in Technical Analysis?

In the context of technical analysis, horizontal levels refer to specific price points on a chart where the price has previously encountered support or resistance. These levels are crucial because they help traders identify potential entry and exit points for trades.

They represent areas where buyers have stepped in to push the price higher (support) or where sellers have halted upward movements (resistance).

Why Are They Important?

- Support Levels: Mark zones where the price tends to stop falling due to increased buying interest.

- Resistance Levels: Highlight areas where the price struggles to rise further as selling pressure increases.

The theory behind horizontal levels is based on market psychology: historical price points where significant activity occurred tend to influence future price movements. This happens because traders often react in predictable ways when the price approaches these key levels, creating a self-reinforcing cycle.

Example: Imagine a stock that repeatedly struggles to break above 150—each time it reaches this level, it falls back. This forms a horizontal resistance level. Conversely, if the price consistently bounces back up from 130, that’s a strong support level. Traders can use these levels to determine entry when buying near support and plan exit points when approaching resistance.

Importance of Horizontal Levels

In the world of technical analysis, many traders consider horizontal levels to be just as crucial as price action, which forms the backbone of Forex trading.

The combination of analyzing price movements alongside horizontal levels allows traders to better understand market trends and anticipate where the price might head next.

While horizontal levels may seem like a basic trading strategy, legendary traders like Jesse Livermore, Warren Buffett, and George Soros have acknowledged their role as the foundation for many of their successful strategies.

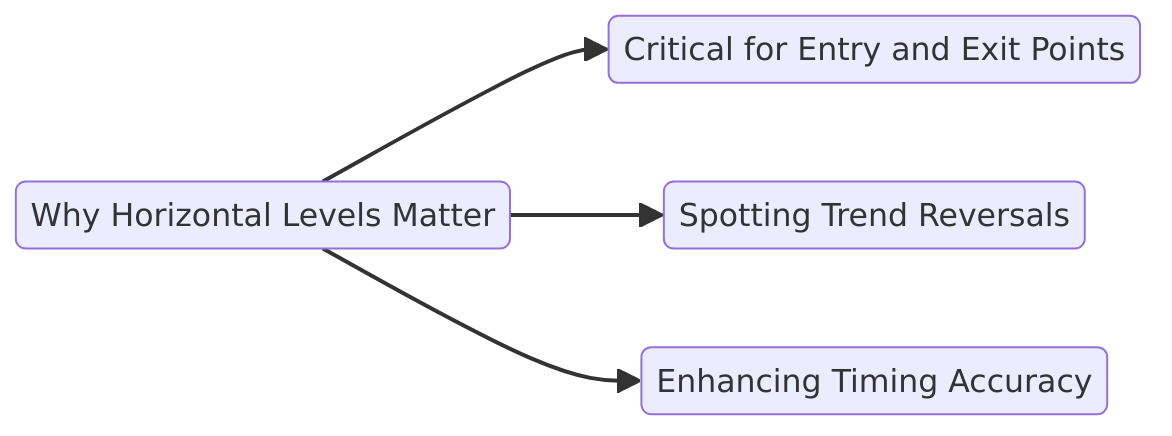

Why Horizontal Levels Matter:

- Critical for Entry and Exit Points: Horizontal levels highlight key price points where traders can identify potential entry and exit points, improving trade timing.

- Spotting Trend Reversals: They help identify areas on a chart where a trend change is likely to occur. This is especially useful when deciding where to place stop-loss orders or when looking for the ideal moment to enter a trade.

- Enhancing Timing Accuracy: In volatile markets, precise timing can make a significant difference. Careful analysis of horizontal levels helps traders fine-tune their decisions, reducing unnecessary risks.

To learn more about How to read and trade the price action – Forex Trading Strategies

Key Levels and Horizontal Support

Key levels and horizontal support are closely related concepts in technical analysis, each offering unique insights into market behavior.

- Key Levels: These are specific price points where the market has experienced significant buying or selling pressure in the past. They often act as psychological barriers where price movements tend to slow down, reverse, or consolidate.

- Horizontal Support: This refers to a price level that acts like a floor, preventing the price from falling further. It’s identified when the price repeatedly bounces off the same level, indicating strong buying interest.

How They Work Together:

- Key levels help traders identify potential areas where the price may react.

- Horizontal support confirms the strength of these levels, providing clarity on whether the price is likely to hold or break.

Horizontal Levels and ‘Swing Points’

The most effective way to utilize horizontal levels in trading is by analyzing swing points—key price points where the trend changes direction. By marking horizontal support and resistance levels at these swing points, traders can identify areas where a trend reversal is likely to occur. This approach helps uncover potential buy or sell opportunities based on historical price reactions.

Key Price Levels from the Chart:

- Resistance Level: Around 103.70

- Support Level: Approximately 86.48

- Swing Point (Old Resistance Turns into Support): Near 97.60

- Upper Price Movement: Reaching up to 115.90

By observing how the price moves within these defined levels, traders can anticipate market shifts with greater accuracy.

Why Swing Points Matter:

- Repetitive Behavior: Swing points tend to repeat over time because traders react similarly to key levels based on past price actions.

- Support-Resistance Flip: As shown in the chart, an old resistance level (around 97.60) eventually turned into a new support level, a concept known as a support-resistance flip.

- Optimizing Entries and Exits: Marking these horizontal levels helps predict the next swing point, allowing traders to enter or exit trades at optimal moments.

Example from the Chart:

The circled areas highlight critical swing points:

- When the price approached 103.70, it struggled to break higher, confirming this level as resistance.

- Conversely, the price consistently rebounded near 86.48, establishing a strong support zone.

- After breaking above 103.70, the price retraced, and this former resistance acted as new support around 97.60—an ideal entry point for traders.

Horizontal Levels, Horizontal Support, and Ranging Markets

Horizontal levels are especially useful in range-bound markets, where the price moves between clearly defined upper and lower boundaries without breaking through. In such markets, traders can accurately predict potential price movements by observing how the price behaves as it approaches these boundaries.

This strategy is commonly used because key levels are often influenced by large market participants like banks and investment funds, whose trading decisions create significant price shifts.

Understanding Ranging Markets:

A range-bound market occurs when an asset’s price fluctuates within a horizontal channel, bouncing between horizontal support (the lower boundary) and resistance levels (the upper boundary). These price points act as barriers:

- Resistance Level (Upper Boundary): The price tends to reverse downward after reaching this point.

- Support Level (Lower Boundary): The price often bounces back upward after hitting this level.

While the price generally respects these levels, it’s important to remember that price action can be unpredictable, and breakouts—where the price moves beyond the range—can occur. Despite this, trading within ranges remains a reliable and low-risk strategy when executed properly.

How to Trade Using Horizontal Levels in Ranging Markets

- Identify the Range:

- Look for price patterns where the price consistently bounces between two clear boundaries.

- Mark these levels as your horizontal support and resistance lines.

- Plan Your Entry:

- Bearish Entry: When the price approaches the upper boundary, expect a downward trend as sellers step in.

- Bullish Entry: When the price nears the lower boundary, anticipate an upward trend driven by buyers.

- Manage Risk and Reward:

- Risk Level: Place your stop-loss just above the resistance or below the support level, depending on your trade direction.

- Reward Level: Target the opposite boundary of the range as your take-profit level.

Horizontal Levels vs. Trendlines

Both horizontal levels and trendlines are fundamental tools in technical analysis, each serving distinct purposes in identifying price movements and market trends. Understanding how they differ—and how they can complement each other—can significantly improve a trader’s ability to make informed trading decisions.

Key Differences Between Horizontal Levels and Trendlines

1. Horizontal Levels:

- Definition: Mark specific price points where the market has previously encountered support or resistance.

- Focus: Based solely on historical price data, highlighting areas where buyers or sellers have reacted strongly.

- Purpose: Pinpoint precise entry and exit points, making them ideal for identifying key support and resistance levels.

- Static Nature: These levels remain constant over time, providing clear reference points regardless of how the price moves horizontally.Example: If a currency pair repeatedly bounces around 1.1000, this level becomes a strong resistance line. When the price breaks above it, the level might act as new support.

2. Trendlines:

- Definition: Drawn by connecting a series of higher lows (in an uptrend) or lower highs (in a downtrend).

- Focus: Incorporates both price and time, illustrating the market’s overall direction.

- Purpose: Helps traders identify the trend’s strength and potential reversal points.

- Dynamic Nature: Unlike horizontal levels, trendlines adjust as new price data emerges, creating a diagonal path that aligns with the current trend.

Example: In an uptrend, drawing a trendline that connects rising lows helps confirm the trend’s momentum. If the price breaks below this line, it could signal a trend reversal.

Horizontal Levels vs. Trendlines: Quick Comparison

| Aspect | Horizontal Levels | Trendlines |

|---|---|---|

| Based On | Historical price data (support/resistance) | Price and time (higher lows/lower highs) |

| Orientation | Horizontal lines | Diagonal lines |

| Primary Use | Identify entry/exit points | Determine market trend direction |

| Nature | Static | Dynamic, adjusts with price action |

| Key Focus | Specific price points | Overall trend structure |

Best Practices for Using Horizontal Levels

To get the most out of horizontal levels, traders should follow these best practices:

- Identifying key levels: Look for price points where the price has previously encountered significant buying or selling activity. These key levels often indicate strong market interest and can serve as potential entry and exit points.

- Confirming levels: Use horizontal support and resistance to confirm the significance of key levels. This confirmation helps ensure that the identified levels are relevant and reliable.

- Combining with other analysis: Use horizontal levels in conjunction with other technical and fundamental analysis to make more informed trading decisions. This combination provides a more comprehensive view of the market.

- Monitoring price action: Continuously monitor price action around horizontal levels to identify potential entry and exit points. Observing how the price behaves near these levels can provide valuable insights into market sentiment.

- Adjusting levels: Adjust horizontal levels as market conditions change to ensure that they remain relevant and effective. Regularly updating these levels helps maintain their accuracy and usefulness.

Common Mistakes to Avoid

When using horizontal levels, traders should avoid these common mistakes:

- Over-reliance on horizontal levels: Horizontal levels should be used in conjunction with other analysis, not as the sole basis for trading decisions. Relying solely on horizontal levels can lead to incomplete and potentially inaccurate conclusions.

- Failure to adjust levels: Failing to adjust horizontal levels as market conditions change can lead to inaccurate trading decisions. Regularly updating these levels ensures they remain relevant and effective.

- Ignoring other market factors: Ignoring other market factors such as trendlines, chart patterns, and fundamental analysis can lead to incomplete trading decisions. A holistic approach to analysis provides a more accurate market view.

- Not monitoring price action: Failing to continuously monitor price action around horizontal levels can lead to missed trading opportunities. Observing price movements near these levels is crucial for timely and informed trading decisions.

- Not using proper risk management: Failing to use proper risk management techniques when trading with horizontal levels can lead to significant losses. Implementing risk management strategies helps protect against adverse market movements and potential losses.

Conclusion

Horizontal levels are one of the simplest yet most powerful concepts in Forex trading, serving as a foundational tool in technical analysis. These levels help traders identify key support and resistance zones, which are critical for making informed decisions about entry and exit points.

While horizontal levels can be used as a standalone strategy, they are even more effective when combined with other tools like trendlines, chart patterns, and technical indicators.

By consistently observing price action around these key levels, traders can uncover potential trade opportunities, anticipate market trends, and enhance their risk management strategies. Whether in trending markets or range-bound conditions, understanding and applying horizontal levels provide a reliable framework for navigating the complexities of financial markets.

Frequently Asked Questions (FAQs)

1. What are horizontal levels in technical analysis?

Horizontal levels are specific price points on a chart where the price has previously encountered support or resistance. They help traders identify potential entry and exit points based on historical price reactions.

2. How do horizontal levels differ from trendlines?

While horizontal levels mark static price points (support and resistance), trendlines are dynamic, connecting higher lows in an uptrend or lower highs in a downtrend to illustrate the overall market direction.

3. Can horizontal levels be used in range-bound markets?

Yes, horizontal levels are highly effective in range-bound markets, where prices bounce between clear support and resistance boundaries. Traders can capitalize on these movements by entering trades near support and exiting near resistance.

4. How do I identify key horizontal levels on a chart?

Look for price areas where the asset has repeatedly reversed or consolidated. These could be historical highs and lows, or zones where significant buying or selling pressure occurred.

5. Are horizontal levels reliable for all market conditions?

While horizontal levels are reliable in both trending and ranging markets, their effectiveness increases when combined with other tools like trendlines, moving averages, and volume indicators to confirm signals and reduce false breakouts.